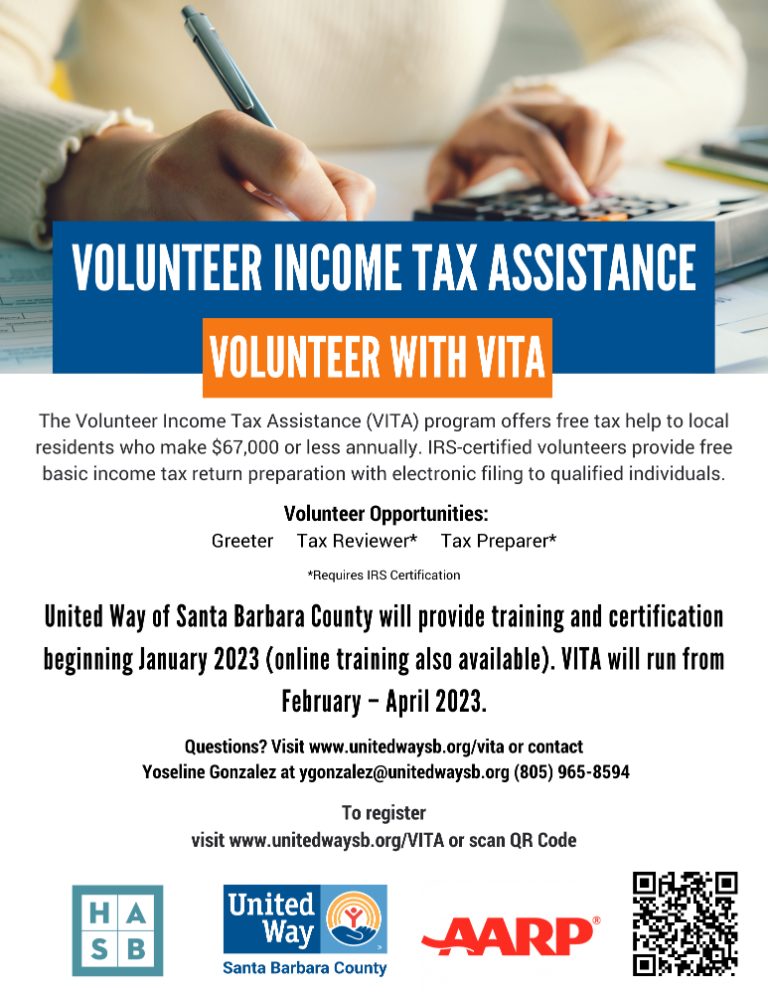

Assist families and individuals with free tax preparation and help build long-term assets! The Volunteer Tax Assistance (VITA) program offers free, basic tax help to those who made $67,000 or less in 2022. IRS-certified volunteers provide free basic income tax return preparation with electronic filing to qualified individuals.

United Way of Santa Barbara County will provide training and certification throughout the month of January 2023 (online self-paced training also available).

United Way training dates: January 7, January 14, and January 21.

VITA will run from February – April 2023.

Volunteer positions available:

Site Greeter: Site Greeter will welcome incoming tax assistance clients, provide directions for completing intake forms, and direct/manage traffic flow at the VITA sites. Volunteers must be bilingual (Spanish and English speaking). This position does not require IRS Certification but volunteers must complete the IRS Standards of Conduct Exam.

Tax Preparer: Tax Preparers will assist tax assistance clients to file their income taxes and answer general tax questions at the VITA sites. Preparers will receive training to become IRS Certified tax preparers. This position requires IRS Certification.

Tax Reviewer: Tax Reviewers will check tax returns for accuracy before final submission to the IRS at various sites in Santa Barbara and Goleta. Tax Reviewers must be IRS Certified as advanced tax preparers and have prior related experience. This position requires IRS Certification.

Leave a Response